Whether you’re a landlord or a tenant, it can be tricky to understand exactly what your insurance needs and responsibilities are. Luckily, Homelet has released an infographic that will clear up a lot of the misunderstandings and help clarify exactly what you need to do to ensure that you’re covered responsibly.

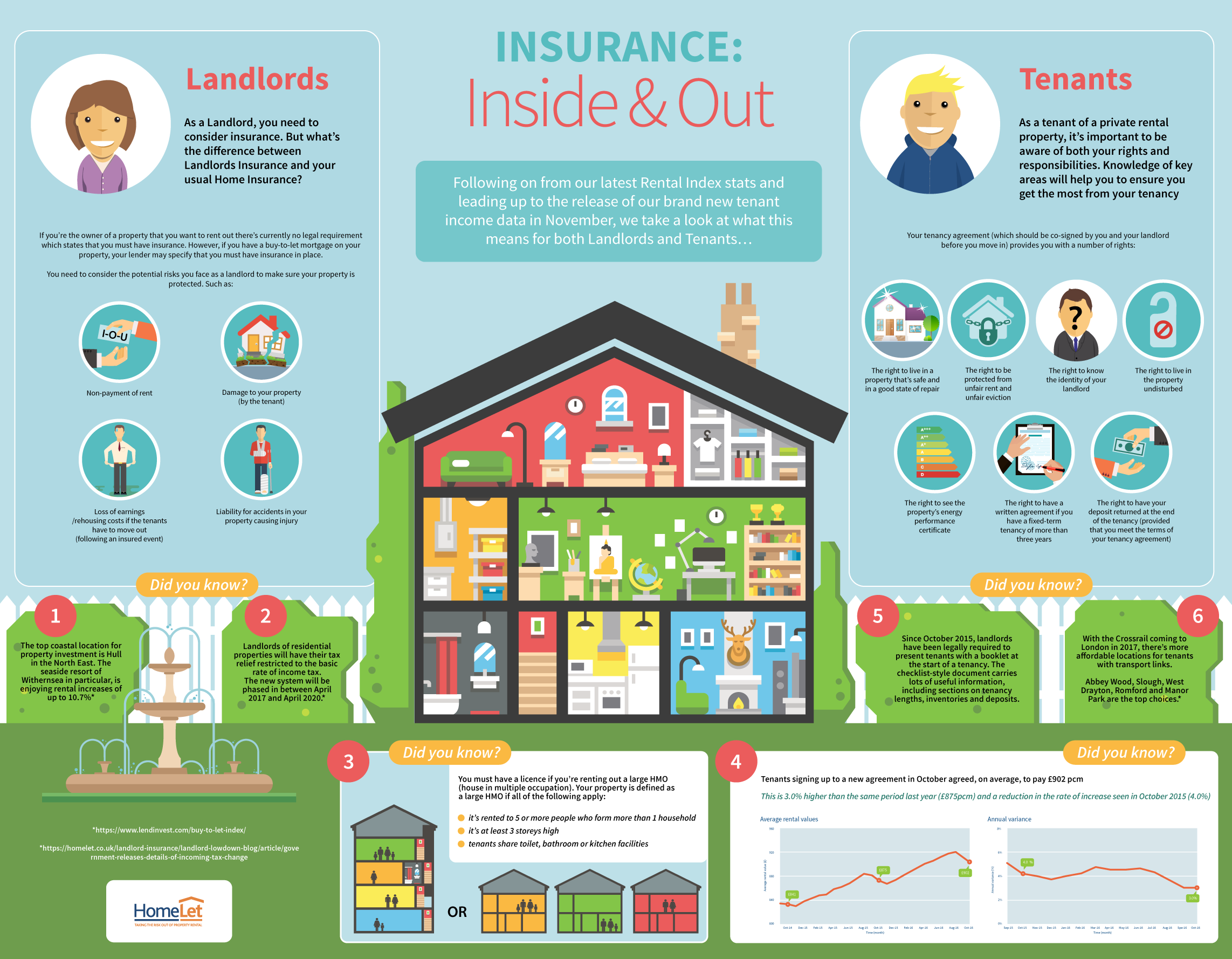

Most landlords know that they need insurance, however it can be tricky to know the difference between Landlord’s Insurance and your normal Home Insurance. If you own a property and you want to rent it out, there’s no legal requirement for insurance. If, however, you have a buy-to-let mortgage on that property, it’s likely that your lender may tell you that you need some form of insurance.

Regardless of whether you legally need insurance, you also need to consider the costs of not having insurance in the event that something goes wrong. This includes if your tenants decide not to pay rent or damage your property, if your tenants suddenly move out and you have no one to fill the property (loss of earnings), along with liability in case there are any accidents in your property that cause injury to a tenant or contractor. For this reason, it simply makes financial sense to ensure that your property is covered if you’ll be renting it out.

Another thing that landlords need to know, is if you have a large HMO (house in multiple occupation) you’ll need a licence. An HMO is when your property is rented to more than 1 household (and five or more people), it’s at least 3 storeys high, and tenants share kitchen, bathroom, or toilet facilities.

Tenants also need to be aware of both their responsibilities and their rights when they’re renting a property. It’s crucial that you’re informed about these points, and have a clear understanding of them. Your tenancy agreement needs to be cosigned by both yourself and your landlord before you actually move into the property.

This tenancy agreement gives you a number of rights, including the right to live in a property that’s both safe, and in a good state of repair. It also prevents you from unfair eviction and unfair rent, and states that you also have the right to know the identity of your landlord, and live in the property undisturbed.

You also have the right to see the energy performance certificate for the property, and if you have a fixed-term tenancy or more than three years, you also have the right to have a written agreement. This agreement will also give you the right to have your deposit returned at the end of the tenancy, provided that the terms of your tenancy agreement are met.

Rents are increasing, and tenants who signed up to a new agreement this past October agreed that on average, they would pay £903 pcm, which is 3% higher than this time last year.

It’s important that both tenants and landlords are knowledgeable about their rights and responsibilities, so be sure to check out this great infographic.